Subscription plans and fees

At FINCI, we believe in complete transparency when it comes to pricing. We understand that hidden fees and unexpected costs can be frustrating and we want to ensure that our customers know exactly what they're paying for.

Compare all plans and features

Switch pricing for accounts

Choose your plan

Choose your plan Choose your plan€50 000 monthly incoming turnover

€250 000 monthly incoming turnover

€500 000 monthly incoming turnover

Individual custom limit

Annual incoming turnover up to 25 000 EUR

Annual incoming turnover up to 500 000 EUR (by request)

Compare all plans and features

Small

€50 000 monthly incoming turnover

€5 /month 2

Get startedMedium

€250 000 monthly incoming turnover

€20 /month 2

Get startedEnterprise

€500 000 monthly incoming turnover

€45 /month 2

Get startedEnterprise +

Individual custom limit

€120 /month 2

Get started

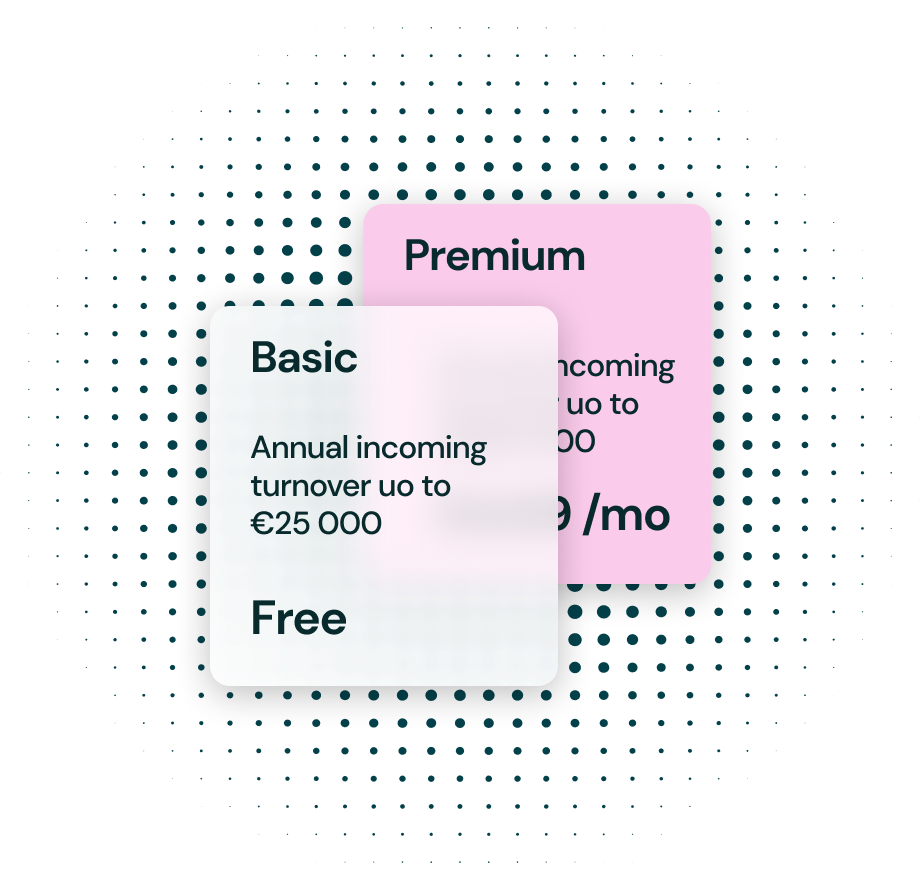

Basic

Annual incoming turnover

up to 25 000 EUR€0 / month 2

Get startedPremium

Annual incoming turnover up to 500 000 EUR (by request)

€4,99 / month 2

Get started

Verification of Client’s documents 3 | €10 | €25 | €100 | €1000 |

Priority verification of Client’s documents 3 | €2000 | €2000 | €2000 | €2000 |

Additional fee for complicated company structure documents verification 4 | Min €50, Max €2000 | Min €50, Max €2000 | Min €50, Max €2000 | Min €50, Max €2000 |

Account opening | €5 | €15 | €50 | €120 |

Additional account opening | €5 | €15 | €50 | €100 |

Temporary account opening | €150 | €350 | €550 | €850 |

Annual fee for overnight balances over 100 000 EUR (charged monthly) 5 | 0.6% | 0.6% | 0.6% | 0.6% |

Closing an account | €10 | €25 | €100 | €200 |

Closing account administration fee 6 (charged daily) | €5 | €5 | €5 | €10 |

Inactive account administration fee 7 (charged daily) | €10 | €10 | €10 | €20 |

Signed account statement in digital or paper format (for each opened account separately) | €25 | €25 | €30 | €50 |

Account statement in digital format for closed accounts 8 | €35 | €35 | €35 | €50 |

Reference letter in paper format 9 | €30 | €30 | €30 | €50 |

Non-standard reference letter (audit, etc.) 9 | Up to €150 | Up to €150 | Up to €200 | Up to €300 |

Increase of monthly debit turnover limit 10 | €15 | €75 | €900 | N/A |

Change of beneficiary / authorized person / ownership structure | €50 per each change | €120 per each change | €150 per each change | €150 per each change |

Intra FINCI payments

| Free of charge | Free of charge | Free of charge | Free of charge |

PAYMENTS IN EUR: | ||||

Payments SEPA, SEPA Instant

11

| €0.25 | €0.30 | €0.40 | 0.2%, Min €5 |

Payments non-SEPA 12 (SHA) 13 | €35 + actual costs 14 | 0.10%, Min €35, Max €100 + actual costs 14 | 0.15%, Min €35, Max €100 + actual costs 14 | 0.20%, Min €50 + actual costs 14 |

Payments non-SEPA 12 (OUR) 15 | €45 + actual costs 14 | 0.10%, Min €45, Max €100 + actual costs 14 | 0.15%, Min €45, Max €100 + actual costs 14 | 0.20%, Min €50 + actual costs 14 |

Payments non-SEPA

12

(SHA)

13

to high-risk countries

27

| 0.25%, Min €120 + actual costs 14 | 0.25%, Min €120 + actual costs 14 | 0.25%, Min €150 + actual costs 14 | 0.25%, Min €150 + actual costs 14 |

Incoming SEPA, SEPA Instant payments 11 | Free of charge | Free of charge | €0.15 | 0.20%, Min €5 |

Incoming non-SEPA payments | Actual costs 14 | Actual costs 14 | €10 + actual costs 14 | 0.20%, Min €25 + actual costs 14 |

Incoming non-SEPA

12

payments (SHA)

13

from high-risk countries

27

| 0.25%, Min €120 + actual costs 14 | 0.25%, Min €120 + actual costs 14 | 0.25%, Min €150 + actual costs 14 | 0.25%, Min €150 + actual costs 14 |

PAYMENTS IN OTHER CURRENCIES: | ||||

Payments within EEA 16 (SHA) 13 | €40 | 0.10%, Min €40, Max €100 | 0.15%, Min €40, Max €150 | 0.20%, Min €50 |

Payments outside EEA 16 (SHA) 13 | €45 + actual costs 14 | 0.10%, Min €45, Max €100 + actual costs 14 | 0.15%, Min €50, Max €150 + actual costs 14 | 0.20%, Min €60 + actual costs 14 |

Payments outside EEA 16

(SHA) 13

to high-risk countries 27

| 0.25%, Min €120 + actual costs 14 | 0.25%, Min €120 + actual costs 14 | 0.25%, Min €150 + actual costs 14 | 0.25%, Min €150 + actual costs 14 |

Incoming payments | €25 | 0.10%, Min €25, Max €50 | 0.15%, Min €25, Max €50 | 0.20%, Min €50 |

Incoming payments from high-risk countries 27

| 0.25%, Min €120 + actual costs 14 | 0.25%, Min €120 + actual costs 14 | 0.25%, Min €150 + actual costs 14 | 0.25%, Min €150 + actual costs 14 |

Issuance of SWIFT 17 or SEPA statement in paper or digital format | €25 | €25 | €25 | €25 |

Non-SEPA incoming payment return | 0.10%, Min €25, Max €100 + actual costs 14 | 0.10%, Min €25, Max €100 + actual costs 14 | 0.10%, Min €25, Max €100 + actual costs 14 | 0.10%, Min €25, Max €100 + actual costs 14 |

Non-SEPA outgoing payment return | Actual costs 14 | Actual costs 14 | Actual costs 14 | Actual costs 14 |

Purchases with card worldwide | Free of charge | Free of charge | Free of charge | Free of charge |

Issuing the digital card 18 | Free of charge | Free of charge | Free of charge | Free of charge |

Issuing the first physical card with standard delivery

| Free of charge | €6 | €6 | €25 |

Issuing the additional physical card with standard delivery 18 | €6 | €6 | €6 | €25 |

Monthly fee for additional card usage (physical or digital) 19 | €2

| €2

| €5 | €15

|

Physical card express issue with courier delivery in Europe 20 | €60 | €60 | €60 | €60 |

Unreasonable reclamation on cards transactions | €20 | €20 | €20 | €20 |

Cash withdrawal from ATMs in Intra-Europe 21, 22 | €1.50 + 2.5% | €1.50 + 2.5% | €1.50 + 2.5% | €3.00 + 3.5% |

Cash withdrawal from ATMs outside Intra-Europe 21, 22 | €2.50 + 2.5% | €2.50 + 2.5% | €2.50 + 2.5% | €3.00 + 3.5% |

Account balance information at any ATM | €0.30 | €0.30 | €0.30 | €0.30 |

Currency exchange mark-up | 0.5% | 1.0% | 1.0% | 2.0% |

Escrow account (standard terms) | 0.5%, Min €100 | 0.5%, Min €150 | 0.5%, Min €200 | 0.7%, Min €400 |

Express escrow account 23 | 0.7%, Min €100 | 0.7%, Min €150 | 0.7%, Min €200 | 0.9%, Min €400 |

Additional fee for non-standard terms of escrow account 23 | Min €350 | Min €350 | Min €350 | Min €350 |

Verification of the documents if the party is not FINCI Client 24 | €5 | €10 | €10 | €30 |

Amendment to the escrow account agreement after signing | €250 | €250 | €250 | €350 |

Manual processing of the payment under Client’s order | €25 | €25 | €30 | €50 |

Investigation and cancellation of a payment order 25 | €70 + actual costs 14 | €80 + actual costs 14 | €90 + actual costs 14 | €120 + actual costs 14 |

Additional user profile custom setup

| €25 | €25 | €25 | €25 |

Transfer of funds (without client's consent) executing a PLAIS order to write off funds 28 | €1.02 | €1.02 | €1.02 | €1.02 |

Fee for investigation of an incoming / outgoing payment of the Client applied by a correspondent bank, beneficiary bank, intermediary bank involved in executing the payment

26

| Actual costs

14

| Actual costs

14

| Actual costs

14

| Actual costs

14

|

First verification of potential Clients' identification documents issued in Country list 1 3 | Free of charge | Free of charge |

First verification of potential Clients' identification documents not issued in Country list 1

3, 4 | Min €200, Max €2000 | Min €200, Max €2000 |

Account opening

| Free of charge | Free of charge |

Annual fee for overnight

balances over 100 000 EUR

(charged monthly)

5 | 0,6% | 0,6% |

Closing an account | Free of charge | Free of charge |

One-time fee on positive balance in case of account closure 6 | Up to €10 | Up to €10 |

Closing account administration fee

7 | €2 per day | €2 per day |

Inactive account administration fee 8 | €5 per day | €5 per day |

Account top-up with any payment card transfer 9 | 3.0% | 3.0% |

Signed account statement in paper or digital format for each opened account separately

| €25 for 10 pages, each next page €0.05 | €15 for 10 pages, each next page €0.05 |

Account statement in digital format for closed account

10 | €25 | €25 |

Issuance of SWIFT/ SEPA statement in paper or digital format on outgoing/ incoming transaction

| €25 | €25 |

Reference letter in paper format

11 | €25 | €15 |

Non-standard reference letter (audit, etc.) 11 | Up to €150 | Up to €150 |

Increase of annual debit turnover limit | Not available | Free of charge |

Intra FINCI payments

| Free of charge | Free of charge |

PAYMENTS IN EUR: | ||

Payments SEPA 12, SEPA Instant | €0.20 | Free of charge |

Payments non-SEPA 13 (SHA) 14 | €20 + actual costs 16 | €15 + actual costs 16 |

Payments non-SEPA 14 (OUR) 15 | €35 + actual costs 16 | €30 + actual costs 16 |

Payments non-SEPA 13 (SHA) 14 to high-risk countries 27 | 0.25%, Min €120 + actual costs 16 | 0.25%, Min €120 + actual costs 16 |

Incoming SEPA, SEPA Instant payments 12 | Free of charge | Free of charge |

Incoming non-SEPA 13 payments | Free of charge + actual costs 16 | Free of charge + actual costs 16 |

Incoming non-SEPA 13 payments (SHA) 14 from high-risk countries 27 | 0.25%, Min €120 + actual costs 16 | 0.25%, Min €120 + actual costs 16 |

PAYMENTS IN OTHER CURRENCIES: | ||

Payments within EEA 17 (SHA) 14 | €40 | €35 |

Payments outside EEA 17 (SHA) 14 | €50 + actual costs 16 | €45 + actual costs 16 |

Payments outside EEA 17 (SHA) 14 to high-risk countries 27 | 0.25%, Min €120 + actual costs 16 | 0.25%, Min €120 + actual costs 16 |

Incoming payments | €25 | €20 |

Incoming payments from high-risk countries 27 | 0.25%, Min €120 + actual costs 16 | 0.25%, Min €120 + actual costs 16 |

Incoming payment return | 0.10%, Min €25, Max €100 + actual costs 16 | 0.10%, Min €25, Max €100 + actual costs 16 |

Outgoing payment return | Actual costs 16 | Actual costs 16 |

Purchases by card worldwide | Free of charge | Free of charge |

Issuing the card in digital format | Free of charge 18 | Free of charge 19 |

Issuing the first physical card with standard delivery

| €6 18 | Free of charge 19 |

Issuing the additional physical card with standard delivery

| Not available | €6 19 |

Monthly fee for additional card usage (physical or digital) | Not available | €1.50 per each card 20 |

Physical card express issue with courier delivery in Europe 21 | €60 | €50 |

Unreasonable reclamation on cards transactions | €20 | €15 |

Cash withdrawal from ATMs in Intra-Europe 22, 23 | €1.50 + 2.5% | Up to €200 and up to 2 times per month is fee free, then €1.00 + 2.5% |

Cash withdrawal from ATMs outside Intra-Europe 22, 23 | €2.50 + 2.5% | €1.00 + 2.5% |

Account balance information at any ATM | €0.30 | Free of charge |

Currency exchange mark-up | 1.0% | 0.5% |

Escrow account (standard terms) | 0.5%, Min €150 | 0.5%, Min €150 |

Express escrow account 24 | 0.7%, Min €150 | 0.7%, Min €150 |

Additional fee for non-standard terms of escrow account 24 | Min €250 | Min €250 |

Verification of the documents if the party is not FINCI Client 4 | €5 | €5 |

Amendment to the escrow account agreement after signing | €250 | €250 |

Manual processing of the payment under Client’s order | €10 | €5 |

Investigation and cancellation of a payment order 25 | €50 + actual costs 16 | €40 + actual costs 16 |

Transfer of funds (without client's consent) executing a PLAIS order to write off funds 28 | €1.02 | €1.02 |

Fee for investigation of an incoming / outgoing payment of the Client applied by a correspondent bank, beneficiary bank, intermediary bank involved in executing the payment

26 | Actual costs 16 | Actual costs 16 |

Give us a call

+370 691 106 93Write an email

[email protected]Contact head of business

[email protected]

Get your tailored business account

Please fill out this short form and your account manager will start preparing a business account tailored to your needs.

How to open an account at FINCI?

Watch our videos with instructions of how to open FINCI account for personal or business

Common Questions Common Questions

How do I open a FINCI personal account?

Does it cost me to open a personal account?

What is a TIN (Tax Identification Number)?

How long does it take to open a business account?

What documentation is required to open a business account?

Can I open a FINCI business account in my country?

Can I open a FINCI Business account if I live outside the Eurozone?

Do business customers get priority support?

Legal information

* Effective from 16.02.2024. Please be informed that some of the products are not fully available yet.

Clients will be informed when products are launched.

1. According to FINCI General Terms and Conditions of Provision of Services - a legal person that is registered or intends to register in the System and intends to have or has a User profile (hereinafter “Client”).

2. Account maintenance fee for Subscription plan.

3. The Fee is paid upon submission of the application for the Client account opening. If FINCI refuses to open Client account, the paid Fee is not returned to the Client.

4. The structure is deemed complex if it does not have immediate transparency of ownership and/or control.

5. An annual fee of 0,6% will be applied on overnight balances over 100000 EUR. The fee will be calculated and charged monthly.

6. FINCI applies Closing account administration fee if the Client fails to fulfil the request of FINCI to transfer the funds from Clients’ Account and/or close the Account within the deadline specified by FINCI.

7. An inactive account is one where no transactions have been made under Client’s instructions for 180 (one hundred eighty) consecutive calendar days. An inactive administration fee applies after 60 (sixty) calendar days from FINCI’s notice for an inactive account status.

8. FINCI does not provide paper format account statements for closed accounts.

9. Standard template letter in paper format issued in EN, LT, RUS or LV languages. Reference letters will be sent in digital format. If Client requires paper format to be send by regular mail, postal costs will be added. Individual pricing based on the type of request will be applied for non-standard reference letters.

10. Fee for evaluation of limit change that applies per each request. Fee is non-refundable in case of refusal on limit increase. Fees are combinable if Client wants to increase the limit and move over several levels of subscription plans.

11. SEPA countries - Andorra, Austria, Belgium, Bulgaria, Croatia, Cyprus, Denmark, Estonia, Finland, France, Germany, Gibraltar, UK, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxemburg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Rumania, San Marino, Spain, Slovakia, Slovenia, Sweden, Switzerland, the Czech Republic, the Vatican City State. Current List of SEPA countries is available here: www.ecb.europa.eu/paym/integration/retail/sepa

12. Payments outside SEPA are processed under TARGET2 is the real-time gross settlement (RTGS) system owned and operated by the osystem. TARGET stands for Trans- opean Automated Real-time Gross settlement Express Transfer system. The current list of TARGET2 is available here: www.ecb.europa.eu/paym/target/target2/profuse/participation

13. SHA - the commission fee of FINCI is covered by the Client, while all commission fees of correspondent banks and the recipient bank related to the payment are covered by the recipient. FINCI sends the payment to the correspondent bank or recipient bank with the instruction SHA in the Details of Charges SWIFT notification field. Correspondent banks or the recipient bank have the right to withhold the commission fees from the transferred amount before or after depositing the funds in the recipient’s account.

14. Actual costs- fees of the third-party financial institutions involved in payment processing.

15. OUR – the commission of FINCI, as well as all commissions of the correspondent bank and recipient bank related to performance of the transfer are covered by the Client. FINCI sends the payment to the correspondent bank or beneficiary bank with indication OUR in the respective SWIFT message area Details of Charges, instructing the beneficiary bank to pay the transfer amount to the recipient. This provision limits the liability of FINCI. FINCI is not liable if the correspondent bank or recipient bank has failed to adhere to the instructions given by FINCI or if the credit transfer has not been received in full due to other reasons not controlled by FINCI.

16. Member-states of the EEA (within the scope of this document): Iceland, Liechtenstein, Norway and 27 EU member-states: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czechia, Denmark, Estonia, Finland, France, Hungary, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

17. SWIFT - (The Society for Worldwide Interbank Financial Telecommunication) is a messaging system that runs on a network of financial institutions globally.

18. FINCI can issue a maximum of 5 cards per Cardholder per month, provided that not more than 3 active cards at one time. If the Client requested for the Cardholder to issue or the Cardholder has been issued with more than 5 cards, FINCI may not individually authorize the issuance of a new additional card or close the issued additional digital cards if circumstances are found to be inconsistent with the FINCI General Terms and Conditions of Provision of Services.

19. If the Client closes an additional card, FINCI may charge a monthly fee at the time of closing the card.

20. If Client orders the card on business day till 13:00, it will be transferred to DHL on the same day after 16:00. If the card is ordered after 13:00, it will be transferred to DHL on the next business day.

21. Intra- Europe: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czechia, Denmark, Estonia, Finland, France, Hungary, Germany, Great Britain, Greece, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

22. Additional fees from ATM systems may apply.

23. The final fee is agreed on case-by-case basis. For express escrow account processed within 24 h on business days. Fees for urgency and non-standard terms are combinable.

24. FINCI may charge a fee of min 200 and max 2000 for the first verification of nationals using a personal identification document issued in countries other than the ones included in the Country List 2 and do not hold a valid residence permit issued in the Republic of Lithuania. The Client is notified of the application of a fee before documents’ verification processing. Country List 2 include: Ireland, Austria, Belgium, Bulgaria, Czech Republic, Denmark, Estonia, Greece, Spain, Italy, Cyprus, Croatia, Latvia, Poland, Liechtenstein, Luxembourg, Malta, the Netherlands, Norway, Portugal, France, Romania, Slovak Republic, Slovenia, Finland, Sweden, Hungary, Germany, Lithuania.

25. FINCI may process investigation and cancellation of a payment order approximately within 10 working days (payments between FINCI accounts, SEPA and SEPA instant) or approximately within 30 calendar days (SWIFT payments).

26. FINCI may apply the fee to investigate transaction in Client’s account according to the request by third party(ies) to finalize the transaction. In case if Client does not submit information and documents in due time, indicated by FINCI in the request and/or in case when submitted documents and information does not correspond to the requirements set by FINCI in the request to the Client, FINCI or other bank can block transaction, return the transaction, and deduct commission.

27. High-risk countries shall be defined based on the internal regulations of FINCI. FINCI reserves the right to amend the list of high-risk countries. A list of high-risk countries can be provided to the Client upon written request.

28. Information System of Cash-Flow Restrictions (abbr. PLAIS in Lithuanian) support fee, which shall be paid to the State Enterprise Centre of Registers, the amount and administration procedure of which are set by the Ministry of Justice of the Republic of Lithuania.

Legal information

* Fees for Individuals effective from 16.02.2024. Please be informed that some of the products are not fully available yet. Clients will be informed when products are available.

1. According to FINCI General Terms and Conditions of Provision of Services - a capable natural person who has reached the age of

18 that is registered or intends to register in the System and who expresses the desire to receive, receives and/or could receive the Services for purposes not related to its business or professional activity (hereinafter “Client”).

2. Account maintenance fee for Subscription plan.

3. Country List 1 include: Ireland, Austria, Belgium, Bulgaria, Czech Republic, Denmark, Estonia, Greece, Spain, Italy, Cyprus, Croatia, Latvia, Poland, Liechtenstein, Luxembourg, Malta, the Netherlands, Norway, Portugal, France, Romania, Slovak Republic, Slovenia, Finland, Sweden, Hungary, Germany, Lithuania, San Marino, Andorra, Switzerland, Singapore, Iceland, Canada, Great Britain, Australia, New Zealand, Japan, South Korea, China.

4. FINCI may charge a fee of min 200 EUR or max 2000 EUR for the first verification of nationals using a personal identification document issued in countries other than the ones included in the Country List 1 and do not hold a valid residence permit issued in the Republic of Lithuania. The Client is notified of the application of a fee before documents’ verification processing. The Fee is paid upon submission of the application for the Client account opening. If FINCI refuses to open Client account, the paid Fee is not returned.

5. An annual fee of 0,6% will be applied on overnight balances over 100000 EUR. The fee will be calculated and charged on a monthly basis.

6. FINCI has right to write off one-time fee up to 10 EUR after Client’s notice on account closing if Client’s account balance is up to 10 EUR and the Client hasn't ensured 0 balance on his account by transferring all his funds from the Client’s FINCI account to any other account specified by the Client before sending a notice on account closing to FINCI.

7. FINCI applies a Closing account administration fee if the Client fails to fulfil the request of FINCI to transfer the funds from Client’s’ Account and/or close the Account within the deadline specified by FINCI.

8. Inactive account is an account where no transactions have been made under the Client’s instructions for the period of consecutive 180 (one hundred eighty) calendar days. An inactive administration fee applies after 60 (sixty) calendar days from FINCI’s notice for an inactive account status.

9. Method of depositing or transferring funds to the Client’s account using payment card. Minimum replenishment (top-up) amount is 10 EUR.

10. FINCI does not provide paper format account statements for closed accounts.

11. Standard template letter in paper format issued in EN, LT, RUS or LV languages. Reference letters will be sent in digital format. If Client requires paper format to be send by regular mail, postal costs will be added. Individual pricing based on the type of request will be applied for non-standard reference letters.

12. SEPA countries - Andorra, Austria, Belgium, Bulgaria, Croatia, Cyprus, Denmark, Estonia, Finland, France, Germany, Gibraltar, UK, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxemburg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Rumania, San Marino, Spain, Slovakia, Slovenia, Sweden, Switzerland, the Czech Republic, the Vatican City State. Current List of SEPA countries is available here: www.ecb.europa.eu/paym/integration/retail/sepa/

13. Payments outside SEPA are processed under TARGET2, which is the real-time gross settlement (RTGS) system owned and operated by the Eurosystem. TARGET stands for Trans-European Automated Real-time Gross settlement Express Transfer system. The current list of TARGET2 is available here: www.ecb.europa.eu/paym/target/target2/profuse/participation/

14. SHA - the commission fee of FINCI is covered by the Client, while all commission fees of correspondent banks and the recipient bank related to the payment are covered by the recipient. FINCI sends the payment to the correspondent bank or recipient bank with the instruction SHA in the Details of Charges SWIFT notification field. Correspondent banks or the recipient bank have the right to withhold the commission fees from the transferred amount before or after depositing the funds in the recipient’s account.

15. OUR – the commission of FINCI, as well as all commissions of the correspondent bank and recipient bank related to performance of the transfer are covered by the Client. FINCI sends the payment to the correspondent bank or beneficiary bank with indication OUR in the respective SWIFT message area Details of Charges, instructing the beneficiary bank to pay the transfer amount to the recipient. This provision limits the liability of FINCI. FINCI is not liable if the correspondent bank or recipient bank has failed to adhere to the instructions given by FINCI or if the credit transfer has not been received in full due to other reasons not controlled by FINCI.

16. Actual costs- fees of the third-party financial institutions involved in payment processing.

17. Member-states of the EEA (within the scope of this document): Iceland, Liechtenstein, Norway and 27 EU member-states: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czechia, Denmark, Estonia, Finland, France, Hungary, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

18. FINCI can issue a maximum of 3 cards per Cardholder per month, but not more than 1 active card at the same time. If the Cardholder has requested or has been issued with more than 3 cards FINCI may not individually authorize the issuance of a new additional card or close the issued additional cards if circumstances are found to be inconsistent with the FINCI General Terms and Conditions of Provision of Services.

19. FINCI can issue a maximum of 10 cards per Cardholder per month, provided that not more than 6 active cards in one time. If the Cardholder has requested or has been issued with more than 10 cards FINCI may not individually authorize the issuance of a new additional card or close the issued additional cards if circumstances are found to be inconsistent with the FINCI General Terms and Conditions of Provision of Services.

20. If the Client closes an additional card, FINCI may charge a monthly fee at the time of closing the card.

21. If Client orders the card on business day till 13:00, it will be transferred to DHL on the same day after 16:00. If the card is ordered after 13:00, it will be transferred to DHL on the next business day.

22. Intra- Europe: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czechia, Denmark, Estonia, Finland, France, Hungary, Germany, Great Britain, Greece, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

23. Additional fees from ATM systems may apply.

24. The final fee is agreed on a case-by-case basis. For express escrow account processed within 8 working hours. Fees for urgency and non-standard terms are combinable.

25. FINCI may process investigation and cancellation of a payment order approximately within 10 working days (payments between FINCI accounts, SEPA and SEPA instant) or approximately within 30 calendar days (SWIFT payments).

26. FINCI may apply the fee to investigate transaction in Client’s account according to the request by third party(ies) to finalize the transaction. In case if Client does not submit information and documents in due time, indicated by FINCI in the request and/or in case when submitted documents and information does not correspond to the requirements set by FINCI in the request to the Client, FINCI or other bank can block transaction, return the transaction, and deduct commission.

27. High-risk countries shall be defined based on internal regulations of FINCI. FINCI reserves the right to amend the list of high-risk countries. A list of high-risk countries can be provided to the Client upon written request.

28. Information System of Cash-Flow Restrictions (abbr. PLAIS in Lithuanian) support fee, which shall be paid to the State Enterprise Centre of Registers, the amount and administration procedure of which are set by the Ministry of Justice of the Republic of Lithuania.

Your finances.

In your pocket.

You’re busy with life. That’s why our easy-to-use app is designed to get out of your way, so you can quickly manage your money and get on with your day. It’s simple. It’s secure. It’s stylish. FINCI mobile app simplifies the process of managing your finances.

Learn more the app