Business accounts tailored to you tailored to you

- Flexible payment services perfect for complex and unconventional businesses

- Personalised support from experts that know your company and industry

We’ve been featured in:

Do business better across borders

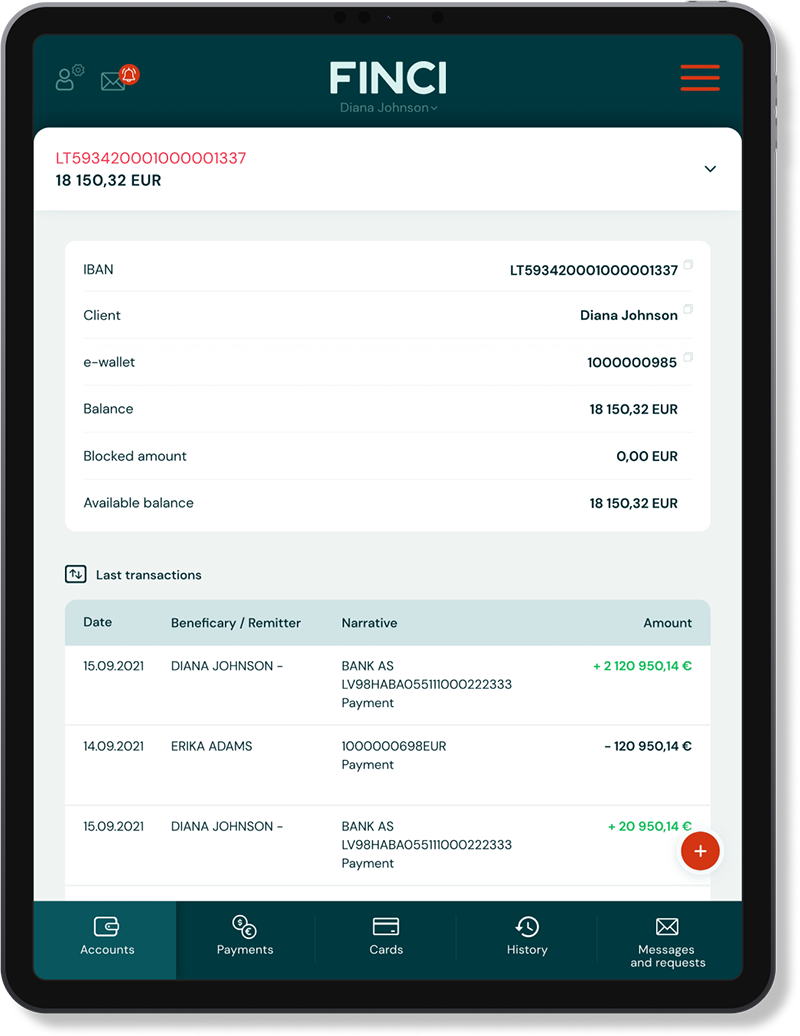

Multi-currency business account

With a FINCI business account you can trade and expand overseas with ease. Send and receive funds in multiple currencies – including GBP, PLN, USD and EUR – all from one dashboard. You’ll love the convenience, just as much as you’ll love avoiding those expensive fees.

Payment networks for business

Get your tailored business account

Please fill out this short form and your account manager will start preparing a business account tailored to your needs.

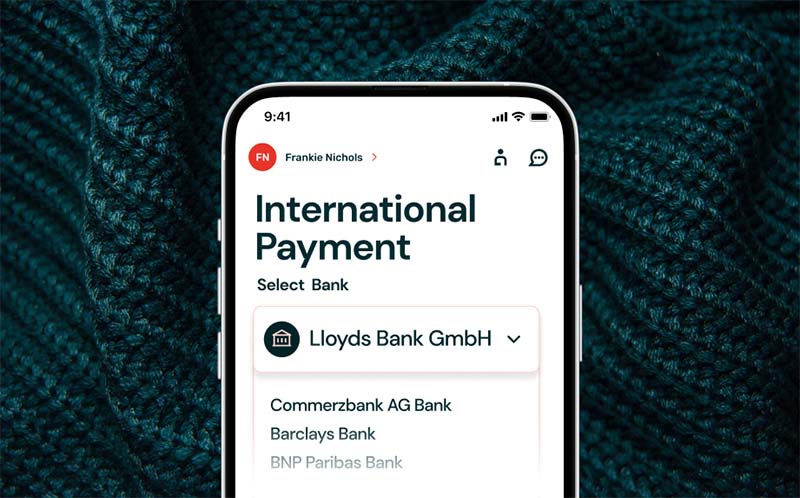

Trade faster with

instant payouts

Business customers can now make high-value international transfers in seconds – instantly paying suppliers, employees and partners in other countries.

- 300K+ Users connected to RippleNet globally

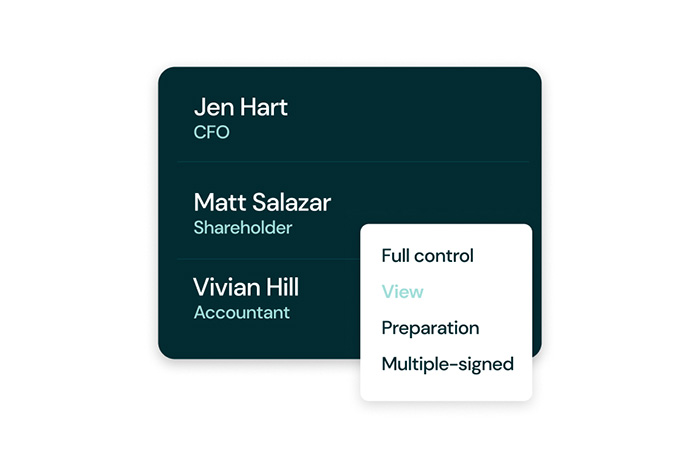

Gain control with user profiles.

Not everyone in your organisation needs the same access to your business account. To improve your internal risk management and gain more control, you can set different user profiles. With four types to choose from, you can assign different permission levels to allow your employees to perform different tasks.

What do our business customers say?

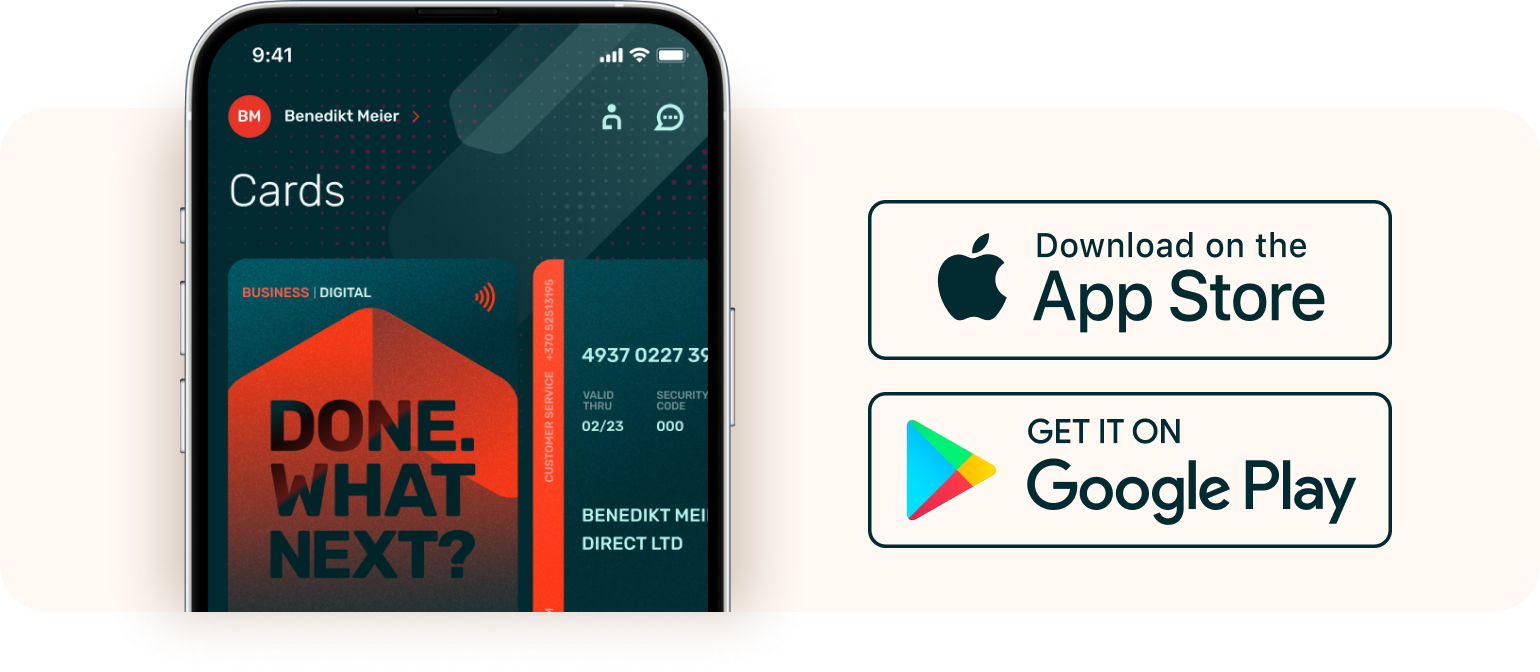

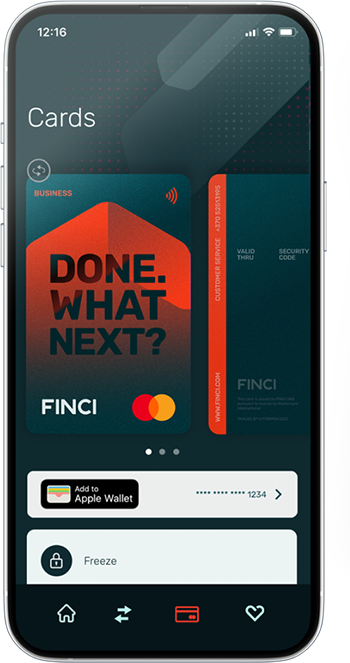

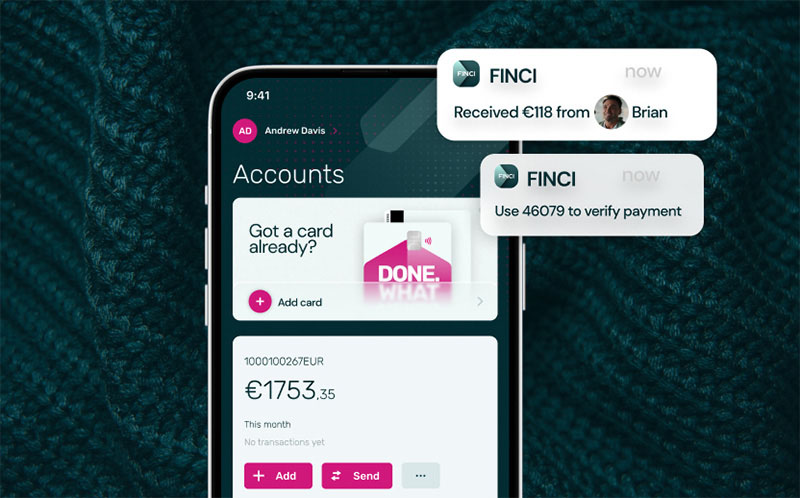

Easily manage your finances on the go, or at your desk.

Quickly and securely manage your business finances all within one app, wherever you are and whatever you’re doing.

Choose your business plan

Choose your business plan

| The first verification of Client’s documents |

| Account Opening |

| Unlimited multicurrency accounts |

| Free payments between FINCI accounts |

| International payments in foreign currencies |

| Free digital payment cards |

| Priority Customer Service |

Serving smart businesses across the globe Serving smart businesses across the globe

Cross-border payments with

are 8x times cheaper than with a

bank.

1000+businesses

rely on FINCI.

It’s easy to open a business account online

Watch this quick video to see how it’s done

Common Questions Common Questions

How long does it take to open a business account?

What documentation is required to open a business account?

Do business customers get priority support?

Can I open a FINCI business account in my country?

Can I open a FINCI Business account if I live outside the Eurozone?

How do I know FINCI is secure?

How do I make sure my card works when our teams are travelling?

What are the card spending limits for Point of Sale (POS) transactions?

What are the card spending limits for online purchases?

What’s the limit for ATM cash withdrawals?

Can I increase or decrease my card spending limits?