Foreign currency payments for your business.

With a multi-currency account you can easily fly funds around the world, while avoiding painful conversion fees.

Open your accountTrade with the world.

More easily.

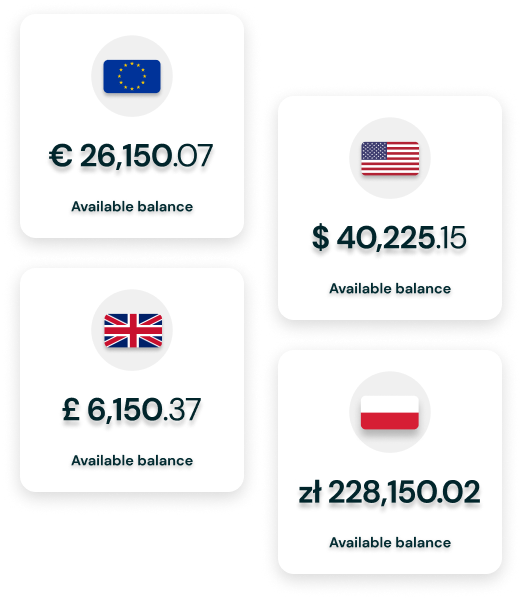

Gone are the days when trading in different currencies was a hassle. Now you can easily trade

GBP, PLN, USD

and

EUR

. And you can apply for a business account online, so there’s no need to travel to a physical branch.

Why get a FINCI business account?

Reduce currency conversion costs

You can avoid the expensive currency conversion fees that banks typically charge and make international business more cost-efficient.

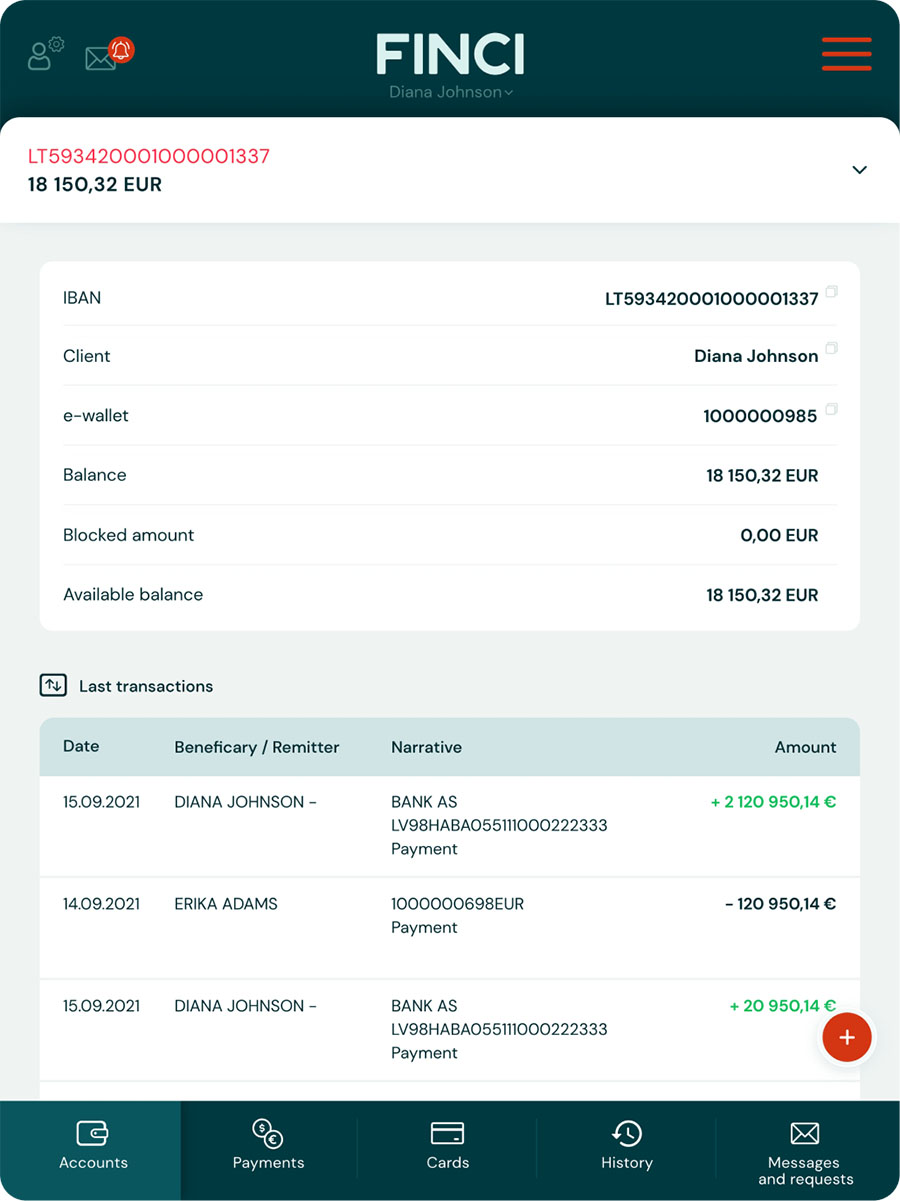

Access one international account

With a multi-currency account, you can make and receive payments in different currencies without having to open separate accounts for each one.

Improve cash flow management

With the ability to hold funds in different currencies, you can better manage your company's cash flow and take advantage of more favourable rates.

Get a personal support manager

Your team will get access to a dedicated account manager – a banking expert that will get to know your unique business needs and deliver personalised service.

Get your tailored business account

Please fill out this short form and your account manager will start preparing a business account tailored to your needs.

Serving businesses across the globe

FINCI has experience working with over 1000 businesses in 31 countries. And we have specialist expertise in supporting complex business structures, with specific know-how in industries such as…

- Aviation

- Logistics

- Maritime

- Wholesale

- Trading Companies

- Technology

Our clients

Your business account at a glance

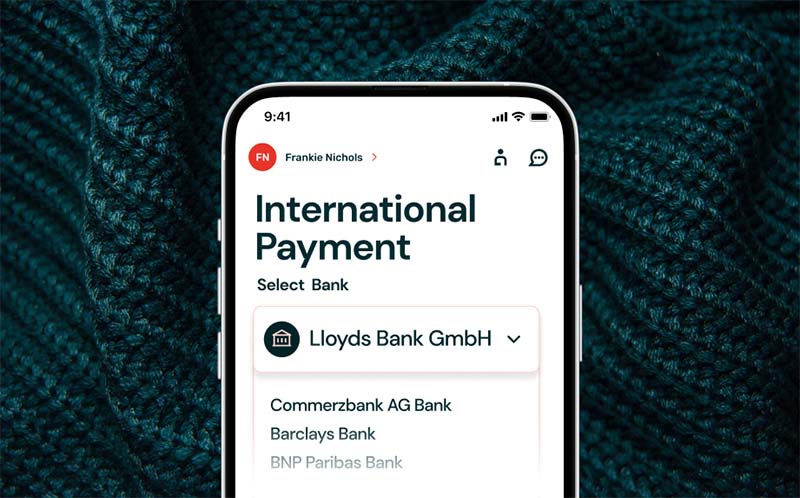

Send money anywhere

- Get access to SEPA and SEPA Instant for faster European payments.

- Our SWIFT membership connects you to 11,000+ financial institutions.

- Our correspondent banks provide global transaction coverage.

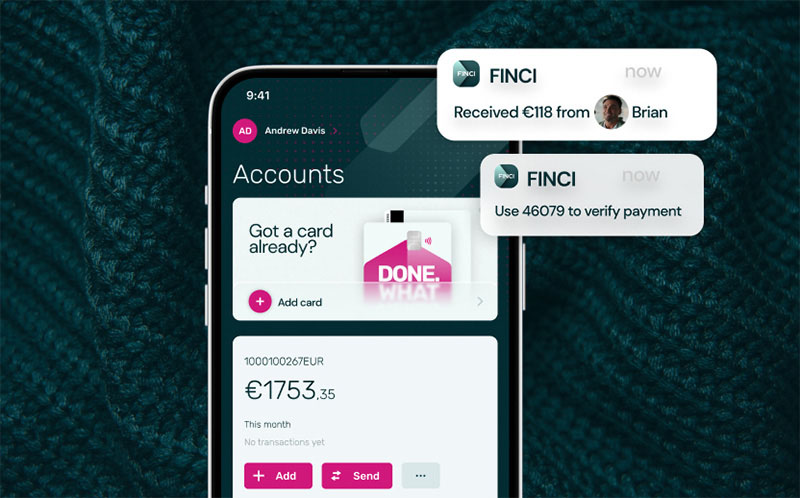

Pay everywhere easily

- Access your account any time with our mobile app or online bank.

- Get help from our team of account managers who are ready to serve.

- Export your transaction history in CSV, PDF, Fidavista, XML and other formats.

Business-class service

Just like on a business-class flight, we understand the importance of exceptional service. So you can count on us to provide high-quality human support, when you need it. And we’re committed to finding customised solutions for your business.

Open an account todayGlobal

Global payments in minutes, not days

In addition to traditional payment options, you can now make instant blockchain-powered payouts from EUR to MXN, INR, and GBP.

Learn more

Learn more

Debit cards that look the business

Get stylish digital and physical debit cards to pay for corporate expenses. Easily order, manage and control all your cards and spend from your business account.

Learn moreChoose your business plan

Choose your business plan

| The first verification of Client’s documents |

| Account Opening |

| Unlimited multicurrency accounts |

| Free payments between FINCI accounts |

| International payments in foreign currencies |

| Free digital payment cards |

| Priority Customer Service |

Securing your peace of mind

FINCI is a Lithuanian-based authorised Electronic Money Institution with full EU passporting. We prioritise the protection of your funds and personal data through advanced data encryption, digital certificates, and sophisticated risk and fraud monitoring.

How we keep you safe

Open a multi-currency account in hours

Our fastest time to open a business account is just 82 minutes. But that’s a record. It could take anywhere from a couple of hours to a couple of days. Watch this video to see how to do it.

Common Questions Common Questions

How long does it take to open a business account?

What documentation is required to open a business account?

Do business customers get priority support?

From what countries can I open a FINCI business account?

Can I open a FINCI Business account if I live outside the Eurozone?

How do I make sure our debit cards work when we’re travelling?

What happens if one of our debit cards goes missing?

What if one of our cards is definitely lost or stolen?

Is FINCI a bank?