Payment services for

the agriculture industry

Get support from a payments provider with specific experience with agriculture companies. With our multi-currency business account, your international payments will flow smoothly across borders as you strive to feed the world.

We’ve been featured in:

Payment services that help you grow

Whether you’re a farmer, a food processor, an equipment manufacturer, or an agtech, slow international payments disrupt your supply chain, impact your operation, and make it harder to stay competitive. Plus, currency conversion fees hurt your bottom line. With FINCI, you can make fast cross-border payments, trade seamlessly with the world, and save on currency conversion fees. All with the support of a dedicated account manager that knows your business and the agriculture industry.

Payment networks for business

Get your tailored business account

Please fill out this short form and your account manager will start preparing a business account tailored to your needs.

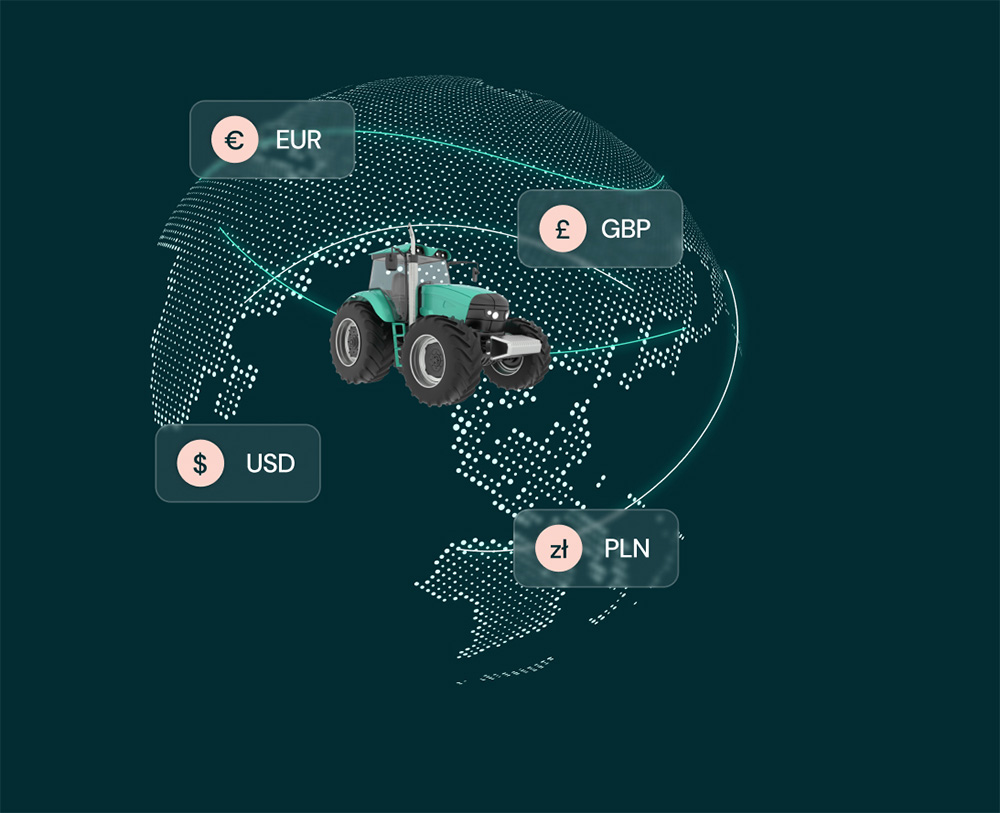

Make global

payments

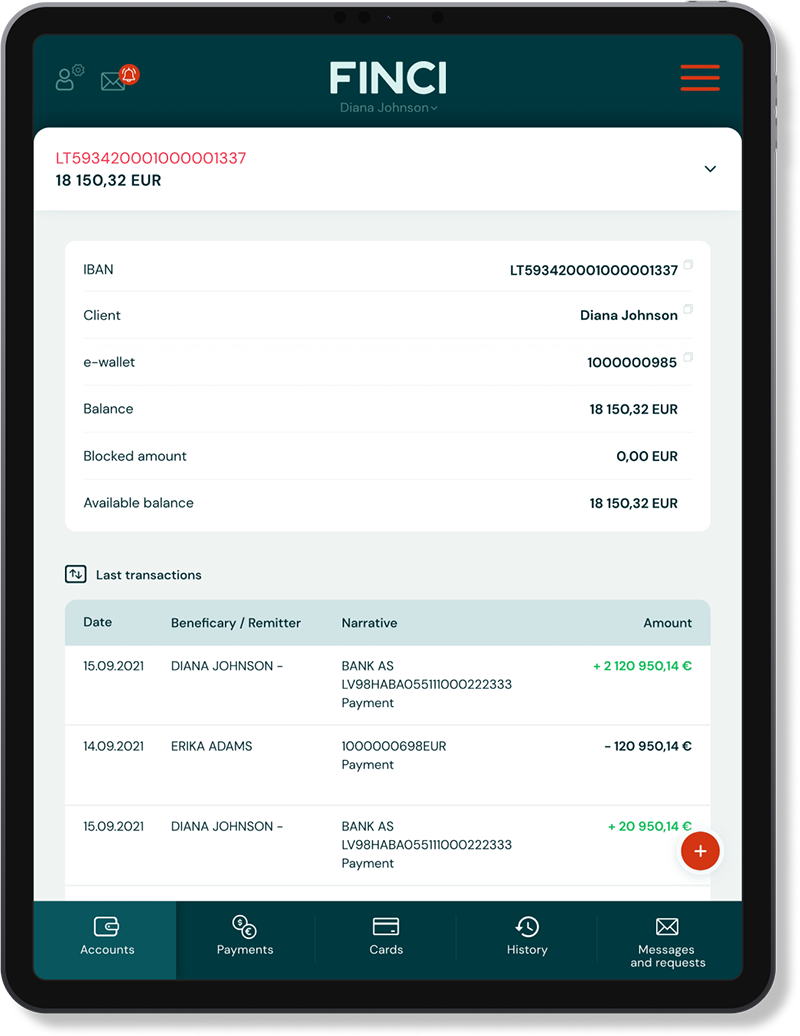

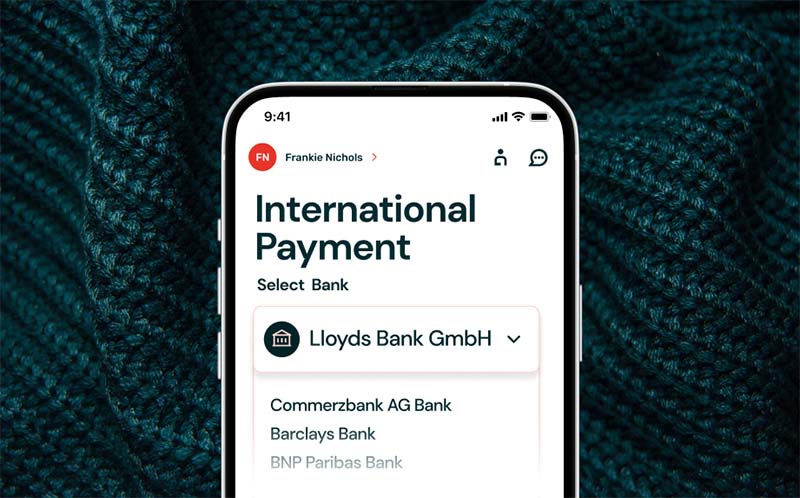

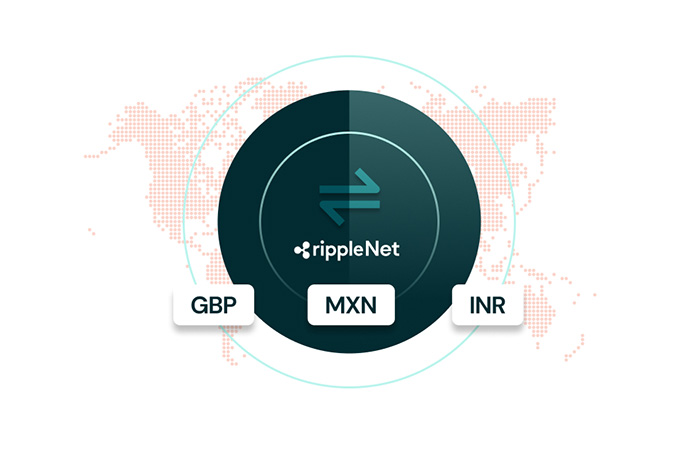

From one multi-currency business dashboard, you can send and receive payments in GBP, PLN, USD and EUR. Additionally, you have the option of making instant global payouts to a wide range of other currencies from your EUR account. With a suite of payment networks available, including SWIFT, SEPA, and SEPA Instant, your funds always get to their destination quickly and securely – just like the crucial parts and materials you need for on-time production.

Pay instantly with RippleNet

The faster you pay suppliers, the better terms you get, the quicker those goods arrive, and the more efficient your agriculture business becomes. With blockchain-powered payments via Ripplenet, you can now make instant global payouts to currencies around the world. Trade with a specific region and want instant payments to that currency? Then please download this form and email to [email protected]. We’ll try to tailor a solution for you.

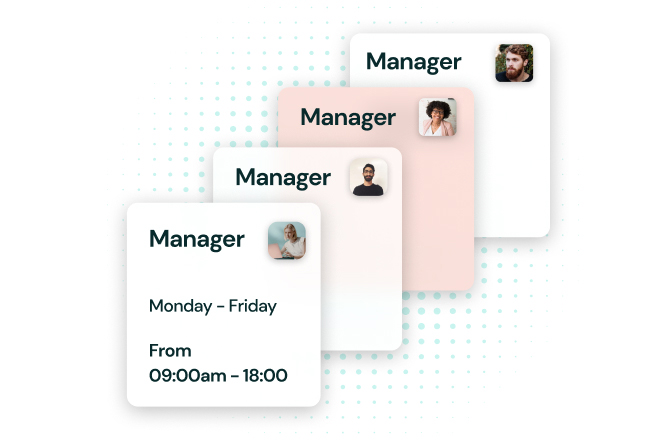

Fill out formGet an account manager

An agriculture business that trades with the world is a complex business. So you need support that goes beyond chatbots and help articles. You need fast and effective human support. That’s why you get a dedicated account manager – a payments expert that knows your industry, your business and can respond rapidly to your specific needs.

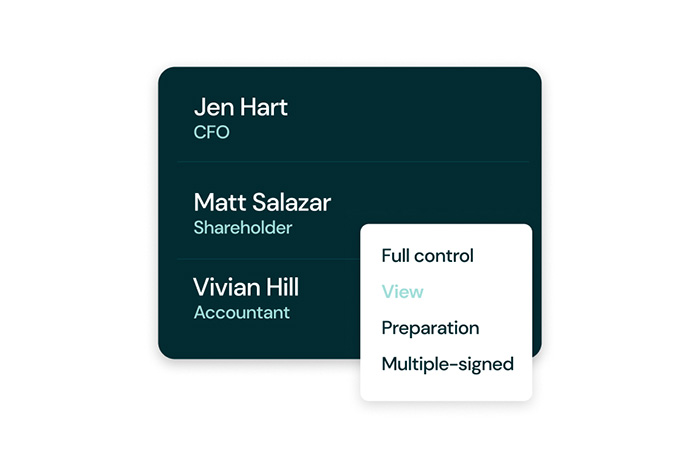

Gain control with user profiles.

Not everyone in your organisation needs the same access to your business account. To improve your internal risk management and gain more control, you can set different user profiles. With four types to choose from, you can assign different permission levels to allow your employees to perform different tasks.

Contact usYour agriculture business can rely on FINCI payments.

Save money on

FX feesWhether you’re paying production, transportation or storage costs, or buying, maintaining and selling equipment, or simply paying your employees around the world – your funds often cross international borders. So currency conversion costs quickly add up. With a multi-currency account, you can minimise these fees, and better manage your cash as it moves around the globe.

Gain compliance

expertiseWith money and goods flowing across borders and legal jurisdictions, you need an extra level of support from compliance. From AML to KYC to international sanctions, our expert compliance officers, with specialist experience in the agriculture industry, will give you peace of mind as you trade.

Building long-term stable relationships

We’re selective about the companies we work with because we give our business customers an extra level of service and care. Instead of serving millions of customers, we prefer to deliver exceptional service to those larger businesses that need more hands-on support. And as a result, we build rock-solid, long-term relationships with our clients.

Complex businesses

Our payments experts, with experience in agriculture, really take the time to understand your business and meet your specific needs.

EU, Asia and USA

We provide seamless global payments, with direct SWIFT payment details to the EU, Turkey, UAE, Singapore, Hong Kong and the USA, etc.

Higher turnover

Experienced processing high-value, high-volume payments, we’re experts at serving larger companies turning over €500K to €50 million per month.

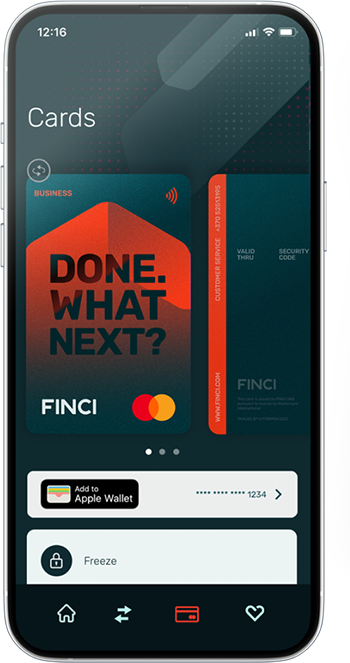

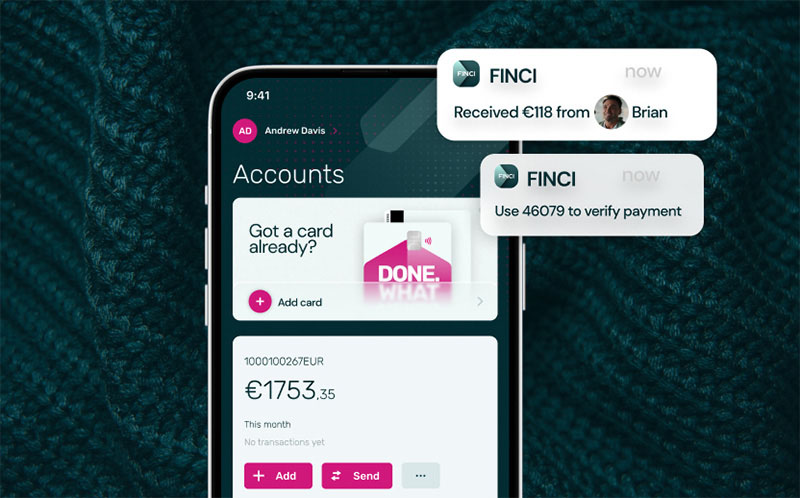

Make payments and track expenses at your desk or

on the go

Quickly and securely manage your business finances all within one app, wherever you are and whatever you’re doing.

Choose your business plan

Choose your business plan

| The first verification of Client’s documents |

| Account Opening |

| Unlimited multicurrency accounts |

| Free payments between FINCI accounts |

| International payments in foreign currencies |

| Free digital payment cards |

| Priority Customer Service |

Privacy and protection

Funds in your FINCI account are held safely and securely. As a regulated entity we are obliged to follow the strictest security practices. But on top of that, we have made additional investments to ensure that security of your funds and data is always our top priority.

Learn about security

Open a multi-currency account in hours

Our fastest time to open a business account is just 82 minutes. But that’s a record. It could take anywhere from a couple of hours to a couple of days.

Common Questions Common Questions

How do I open a FINCI business account?

How long does it take to open a business account?

Is there a faster way to open an account?

Can I maintain multiple currencies in my business account?

What’s the benefit of a multi-currency account to an agriculture firm?

Which payment networks do you provide access to?

How do these payment networks help my agriculture company?

Do you offer debit cards for our employees?

How can I request and manage payment cards for my team?

Are there any spending limits or controls for employee cards?

How does my account manager help my agriculture business?

How can I get in touch with my account manager?

Is FINCI licensed?

How do I know my funds are secure?

Can you provide details about data privacy and compliance policies?

Do you charge any fees for opening a business account?

Can we connect to your API?

Can I add additional users for the account?

Business services for a better business

Get your tailored business account

Please fill out this short form and your account manager will start preparing a business account tailored to your needs.

Business account opening in 3 simple steps.

STEP 1

Create a free personal account via the app.

STEP 2

Log in to the online bank via desktop

STEP 3

Proceed with business account opening

Business account opening in 3 simple steps.

STEP 1

Create a free personal account via the app.

STEP 2

Log in to the online bank via desktop

STEP 3

Proceed with business account opening